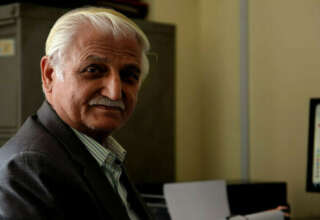

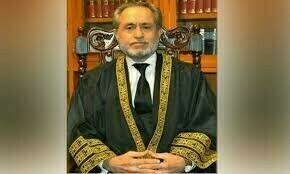

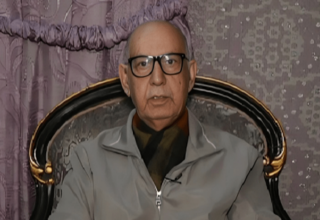

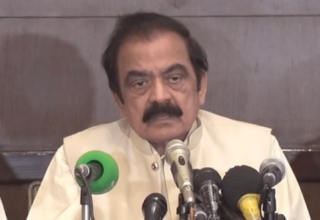

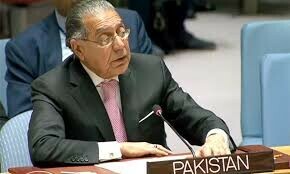

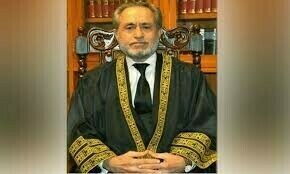

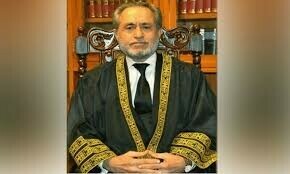

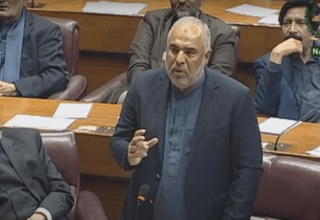

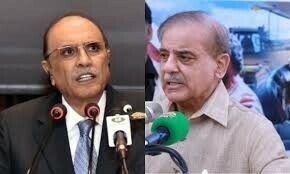

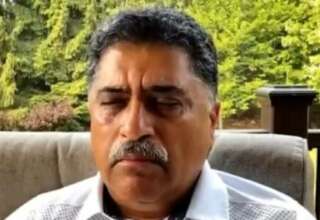

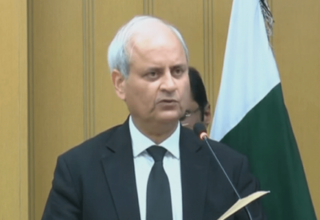

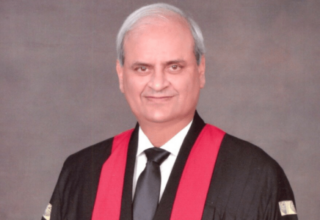

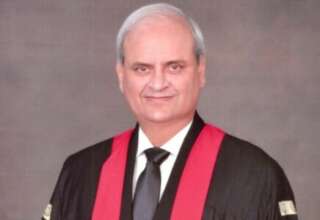

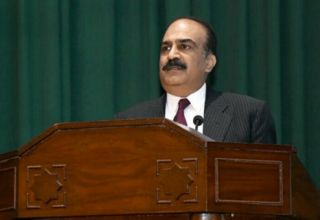

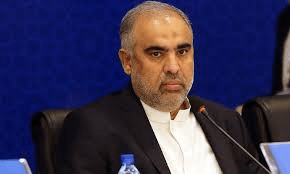

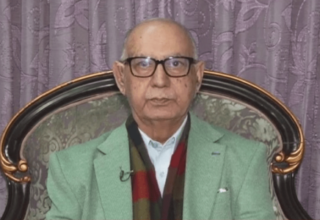

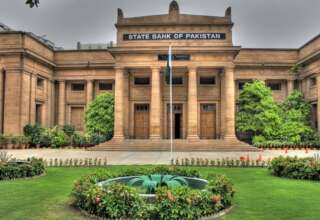

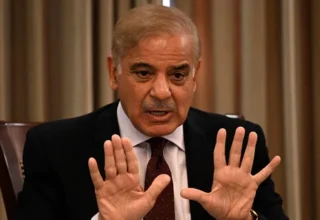

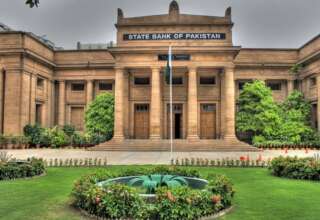

KARACHI: State Bank of Pakistan (SBP) Governor Jameel Ahmad said on Wednesday the institution plans to launch a pilot for a digital currency and is finalising legislation to regulate virtual assets as the government ramps up efforts to modernise the country’s financial system.

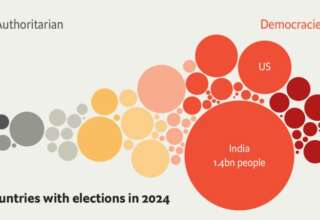

Central banks globally are exploring the use of digital currencies as interest in blockchain-based payments grows. Pakistan’s move follows similar steps by regulators in China, India, Nigeria and several Gulf states to test or issue digital currencies through controlled pilot programmes.

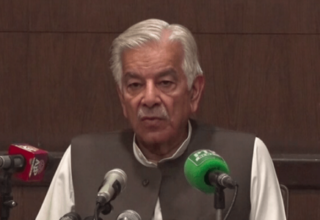

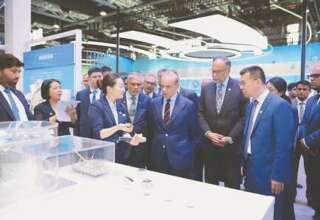

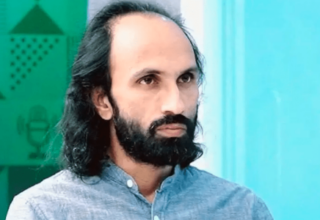

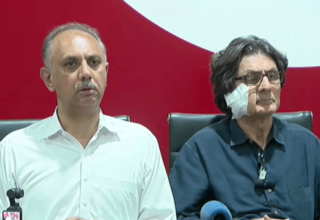

At the Reuters NEXT Asia summit in Singapore, Ahmad said Pakistan was “building up our capacity on the central bank digital currency” and hoped to roll out a pilot soon.

He was speaking on a panel alongside Sri Lanka’s central bank governor, P. Nandalal Weerasinghe, with both discussing monetary policy challenges in South Asia.

Ahmad said a new law would “lay down the foundations for the licensing and regulation” of the virtual assets sector and that the central bank was in touch with some tech partners.

The move builds on efforts by the Pakistan Crypto Council (PCC), set up in March by the government to drive virtual asset adoption.

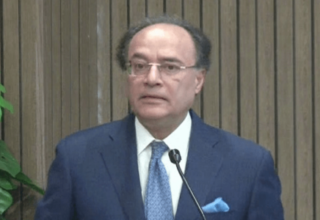

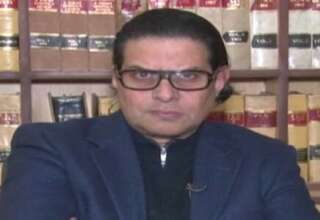

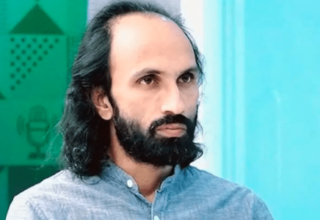

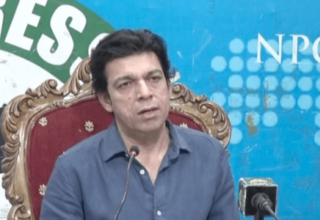

Bilal bin Saqib, PCC chief executive officer and state minister on blockchain and crypto, said in a statement today that the government had approved the Virtual Assets Act 2025, creating an independent regulator to license and oversee the crypto sector.

The PCC is exploring bitcoin mining using surplus energy, has appointed Binance founder Changpeng Zhao as a strategic adviser and plans to establish a state-run Strategic Bitcoin Reserve .

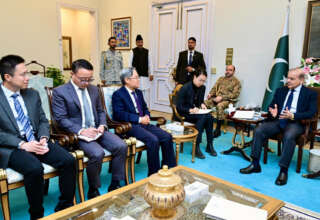

It has also held talks with US-based crypto firms, including the World Liberty Financial linked to US President Donald Trump.

In May, the SBP clarified that virtual assets were not illegal . However, it advised financial institutions not to engage with them until a formal licensing framework was in place.

“There are risks associated, and at the same time, there are opportunities in this new emerging field. So we have to evaluate and manage the risk very carefully, and at the same time not allow to let go of the opportunity,” he said on the panel.

Ahmad said the SBP would continue to maintain a tight policy stance to stabilise inflation within its 5–7 per cent medium-term target.

Pakistan has cut its benchmark rate from a peak of 22pc to 11pc over the past year, as inflation slumped from 38pc in May 2023 to 3.2pc in June, averaging 4.5pc in the 2025 fiscal year just ended, a nine-year low .

“We are now seeing the results of this tight monetary policy transfer, both on our inflation as well as on the external account,” he said.

Ahmad said Pakistan was not overly exposed to dollar weakness, noting its foreign debt was mostly dollar-denominated and only 13pc comprised Eurobonds or commercial loans.

“We don’t see any major impact,” he said, adding that reserves had risen to $14.5 billion from under $3bn two years ago.

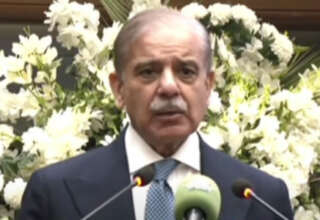

Ahmad said Pakistan’s three-year $7bn IMF programme , which runs through September 2027, was on track and had resulted in reforms in fiscal policy, energy pricing and the foreign exchange market.

“We are confident that after that [IMF programme], maybe we will not require an immediate [follow-up].”

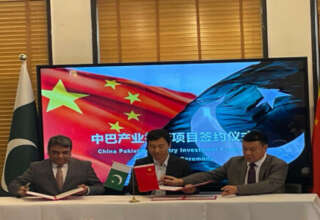

Asked whether Pakistan had financing plans lined up for upcoming military equipment purchases, particularly imports from China, the SBP governor said he was not aware of such plans.

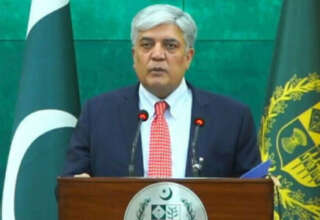

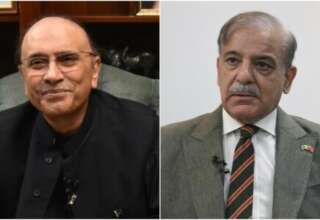

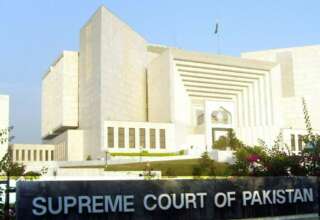

Earlier today, the government formally approved the Virtual Assets Act, 2025, following endorsements from the federal cabinet, the prime minister and the president, the Associated Press of Pakistan reported.

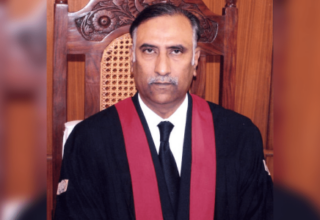

The law establishes the Pakistan Virtual Asset Regulatory Authority (PVARA), an autonomous federal body empowered to licence, regulate and supervise entities dealing in virtual assets, according to a press release issued by the office of the special assistant on blockchain and cryptocurrency.

The authority has been granted comprehensive powers to ensure transparency, compliance, financial integrity, and the prevention of illicit activities, in alignment with international standards, including those of the Financial Action Task Force.

The board of the authority will include key government stakeholders, such as the SBP governor, secretaries of finance, law and justice, and information technology and telecommunications, as well as the chairpersons of the Securities and Exchange Commission of Pakistan (SECP), the Federal Board of Revenue (FBR) and the Digital Pakistan Authority.

Additionally, two independent directors with expertise in virtual assets, law, finance, or technology will be appointed by the federal government. The chairperson, appointed on the basis of demonstrated experience in finance, law, technology, or regulatory affairs, will oversee the authority’s functions.

Under the act, any person or company intending to offer virtual asset services in or from Pakistan must be licensed by the authority. A structured licensing regime will be introduced, with specific requirements for incorporation, operational capacity, compliance frameworks and reporting obligations.

The legislation also incorporates a framework for responsible innovation by establishing a regulatory sandbox, allowing emerging technologies and business models to be tested under supervisory oversight. In addition, the authority may issue no-action relief letters under defined conditions to facilitate experimentation while preserving regulatory accountability.

To ensure compatibility with Islamic finance principles, the law mandates the formation of a shariah advisory committee, which will advise the authority on matters related to the shariah compliance of virtual asset products and services.

Licensed entities offering Islamic financial products will be bound by the rulings issued by the committee.

The act also provides for the establishment of a virtual assets appellate tribunal to hear appeals against regulatory decisions. The tribunal will function with judicial independence and a specialised bench comprising experts in law, finance, and technology.

“With this forward-looking legislation, Pakistan takes a major step in shaping a secure, inclusive and innovation-friendly digital financial ecosystem, ensuring that technological progress is matched with institutional readiness and public interest safeguards,” APP said.