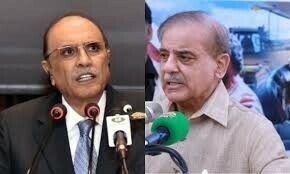

ISLAMABAD: The federal cabinet on Tuesday approved the restructuring of Pakistan International Airlines (PIA) but directed its specialised panel to sort out differences between the ministries of finance and privatisation over financial implications of the bifurcation of the airline for the budget.

The cabinet gave the green light to invite interests from potential investors for selling 51% to 100% stake of PIA – Pakistan’s third highest loss-making entity. Prime Minister Anwaarul Haq Kakar chaired the cabinet meeting.

The cabinet was apprised that the Supreme Court had barred the government in 2018 from taking further steps for PIA privatisation without its prior consent. The privatisation ministry has filed a petition to inform the court about the developments but it has not yet got a hearing date.

According to the PM Office, the cabinet approved the restructuring of PIA. The Cabinet Committee on Privatisation (CCOP) was directed to resolve the issue related to payables of government-owned departments, said a press statement.

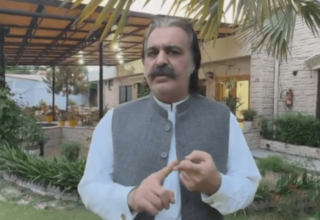

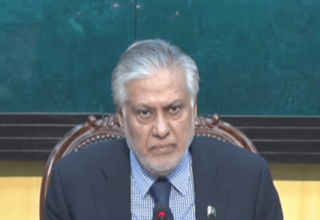

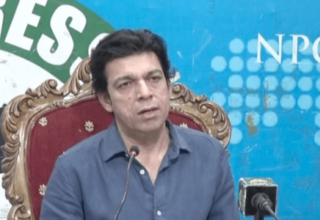

The privatisation ministry did not first take the matter to the CCOP and took it directly to the cabinet. The CCOP, like the Privatisation Commission board, is also chaired by Privatisation Minister Fawad Hasan Fawad, which leaves little room for an independent oversight.

The CCOP will meet on Wednesday to iron out differences between the finance ministry and the privatisation ministry.

The cabinet’s approval was sought for setting up a new holding company and transferring Rs622 billion to the firm, selling 51% to 100% stake of PIA and shifting the employees of Precision Engineering Complex (PEC) to the holding company. Cabinet members appeared to be in agreement but due to objections from the Ministry of Finance it was decided to hand over the new structure’s financial issues to the CCOP, according to a member of the cabinet.

Financial advisers have proposed a major incentive for the buyers by allowing the use of PIA’s deferred tax assets for 10 years instead of six years. However, this requires an amendment to the Income Tax Ordinance, which the finance ministry has opposed.

The cabinet gave approval for a bridge financing of Rs10 billion, to be arranged from the Civil Aviation Authority (CAA).

The cabinet was informed that foreign investors could not buy more than 50% shares under the Civil Aviation Act and Air Service Agreements. So, the foreign investors would have to enter into an arrangement with local investors for acquiring majority shares.

The financial advisers have submitted the draft of restructuring, legal segregation and transaction structure. But they have failed to submit the valuation report.

Sources said that the finance ministry opposed the privatisation ministry’s proposal to write off PIA’s debt of Rs140 billion. It also expressed concerns that no firm timeline had been given for the airline’s privatisation. The Ministry of Finance opposed the transfer of Rs622 billion worth of debt to the holding company and instead recommended to keep some part of it with the core PIA. It also refused to provide any liquidity support to PIA before and after its privatisation.

In a major objection, the finance ministry said that there should be clarity about the valuation of PIA before and after its segregation. It opposed the extension of the benefit of deferred tax assets from six years to 10 years, saying it could set a precedent for other loss-making entities.

The Ministry of Finance’s main objection was that PIA’s debt and liabilities settlement plan should be prepared in a systematic manner. It opposed the privatisation ministry’s focus mainly on transferring Rs268 billion worth of commercial banks’ debt to the federal government books.

The International Monetary Fund (IMF) on Monday did not approve the PIA’s debt restructuring plan and sought more details, particularly the treatment of the Federal Board of Revenue (FBR), CAA and Pakistan State Oil (PSO) debt.

The finance ministry highlighted that the privatisation ministry had not yet secured the concurrence of all private and public sector lenders, and service providers for the segregation of PIA into two entities.

The financial advisers’ report revealed that as of September 2023, PIA’s equity turned negative by a whopping Rs663 billion.

It has been proposed that negotiations should be held with potential investors to retain PIA employees for three years. There is still a need to update PIA liabilities till December 31 before its bifurcation.

Core and non-core

The financial advisers recommended that the Precision Engineering Complex, Pakistan International Investment Limited owning Roosevelt Hotel and Scribe Hotel and certain real estate assets should be treated as non-core assets and should not be privatised.

All ancillary services including engineering, ground handling, cargo, flight kitchen and training, as core assets, should be retained in main PIA for privatisation. However, the advisers underlined that their treatment as core assets would depend on the investors’ willingness to buy them.

Liability plan

The financial advisers proposed that the liabilities of Rs622 billion as of September 2023 should be transferred to a new holding company along with assets. These transferable liabilities include Rs268 billion in commercial bank debt.

However, the government would need no-objection certificates from these banks before filing the scheme of arrangement with the SECP.

The Rs173 billion debt due to be paid to the federal government and advances from subsidiaries should also be transferred to the holding company. Similarly, all liabilities of Rs144 billion of the CAA, PSO and National Insurance Corporation Limited should be transferred to the holding company.

The advisers proposed to transfer Rs38 billion in pension liabilities to the federal government. The Rs6 billion worth of real estate, Rs6 billion in overdue advances and Rs8 billion worth of subsidiary balances are also proposed to be transferred to the holding company. The financial advisers proposed that the liabilities of Rs203 billion, mainly of foreign banks, should be retained in PIA along with Rs141 billion in operating assets.

The breakdown of Rs203 billion worth of liabilities showed that all commercial debt of Rs16 billion owed to foreign commercial banks should be retained in PIA. Payables of Rs64 billion to creditors mainly lessors and fuel suppliers should also be retained in PIA and offered to the buyers.

The advisers proposed that the operational liabilities of 104 billion related to fleet, employees deferred liabilities and trade payables may be retained in PIA.