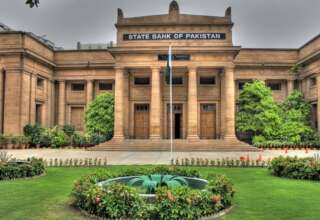

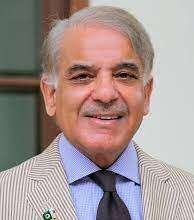

KARACHI: The benchmark index of the Pakistan Stock Exchange (PSX) continued its upward momentum on Thursday to cross the 64,000 milestone in yet another record high.

According to the PSX website, the KSE-100 index gained 380.55 points at 10:20am to reach 64,298.27, up 0.6 per cent from the previous close of 63,917.72.

The benchmark of representative shares, maintaining its bull run from the preceding week, had briefly crossed the 64,000 level a day earlier but retracted towards to the end of the session.

Analysts said the index has gained 54.5pc since Pakistan signed a loan agreement with the International Monetary Fund (IMF) in July.

Capital market expert Mohammad Saad Ali said the market was not worried about a potential delay in the disbursement of the IMF tranche until January following the successful Staff Level Agreement.

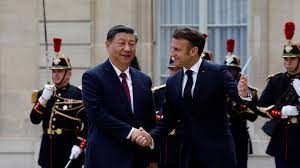

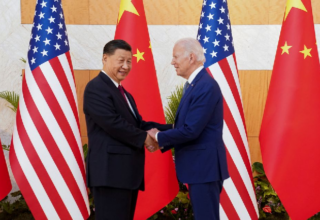

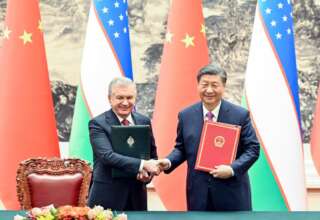

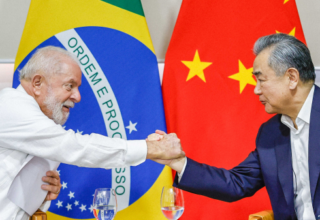

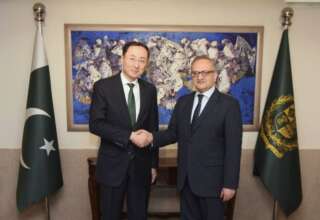

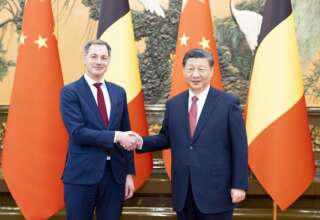

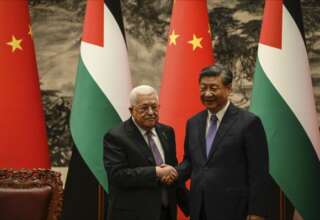

He also noted two new positive developments: potential Chinese investment in the Pakistan Refinery Limited, which had raised expectations of the passing of the long-delayed refinery policy, and correction in oil prices amid global demand worries.

Mohammed Sohail, chief executive of Topline Securities, echoed the same sentiments of falling global oil prices propelling the benchmark index.

“Moreover, continuous foreign buying is boosting sentiments of local investors,” he added.

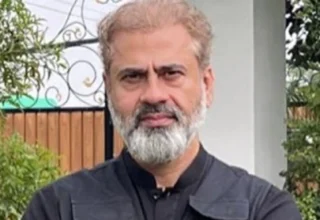

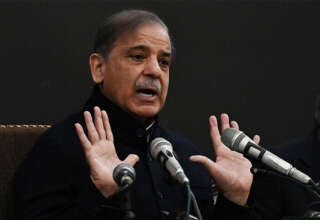

Shahbaz Ashraf, chief investment officer at FRIM Ventures, said: “This bullish momentum is not limited to specific sectors; rather, it is spread across the board.”

He highlighted that foreign investments had infused the “recent excitement”, invoking a positive market re-rating.