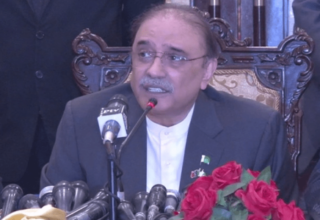

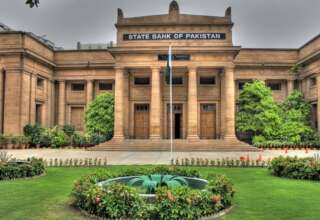

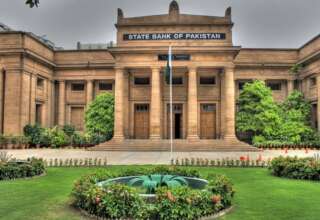

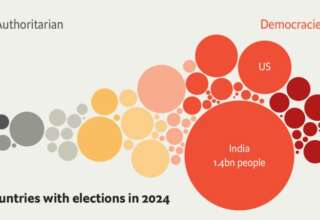

ISLAMABAD: The International Monetary Fund (IMF) on Friday approved the immediate disbursement of about $1 billion to Pakistan under the ongoing Extended Fund Facility, according to the Prime Minister’s Office (PMO).

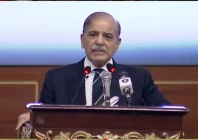

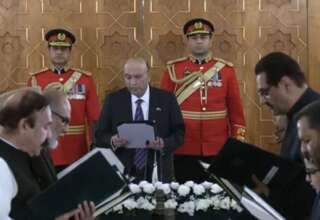

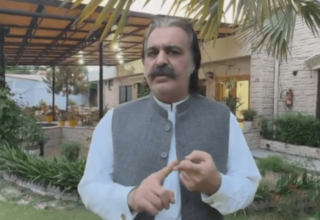

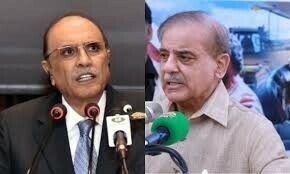

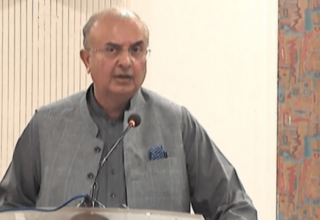

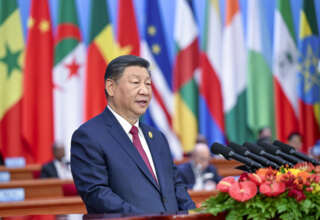

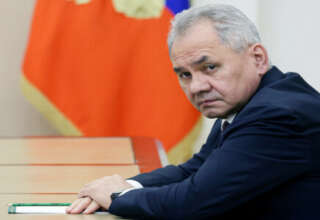

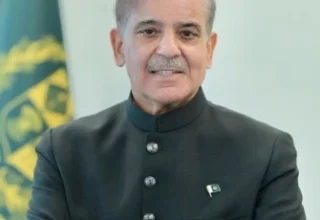

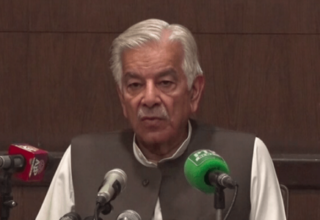

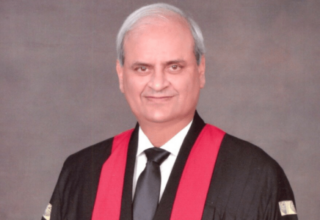

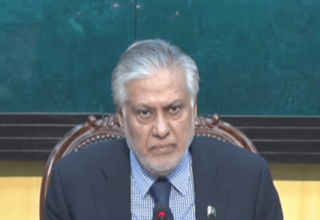

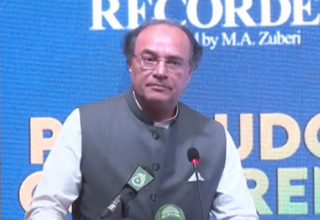

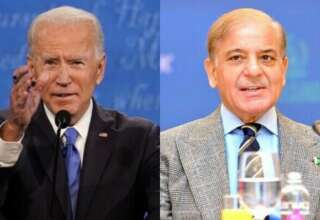

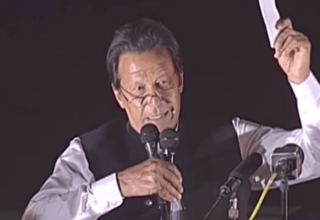

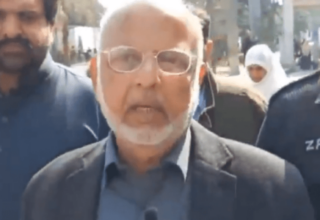

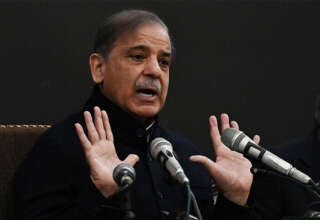

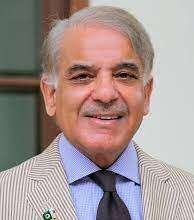

“Prime Minister Shehbaz Sharif expressed satisfaction over the approval of a $1bn dollar instalment for Pakistan by the IMF and the failure of India’s high-handed tactics against it,” the PMO said.

“The country’s economic situation has improved and the country is moving towards development. India is plotting a conspiracy to divert attention from our country’s development through unilateral aggression.

“International institutions have responsibly rejected India’s false propaganda. Indian attempts to sabotage the IMF programme have failed,” it quoted the prime minister as saying.

The premier said the programme would help stabilise the economy and put it on the path towards long-term recovery, adding that the government was working on priority areas such as tax reform, improved energy sector performance and private sector development.

“The improved economic indicators in the last 14 months are a reflection of the government’s positive policies.

“Pakistan’s economic stability strategy, effective performance and sustainable planning are committed to this,” the statement said.

The approval of the IMF’s executive board has led to an immediate disbursement of $1bn, bringing total disbursements under the loan programme to about $2bn. On successful completion of seven half-yearly reviews, Pakistan is entitled to seven equal instalments of about $1bn (SDR 760 million) under the loan programme.

Pakistan and the IMF had reached a three-year, $7bn aid package deal in July, with the new programme set to allow the country to “cement macroeconomic stability and create conditions for stronger, more inclusive and resilient growth”.

The two sides had reached a staff-level agreement on March 25 on the first biannual review of the 39-month $7bn loan programme, agreeing on a series of reforms including the introduction of a carbon levy, timely revisions to electricity tariffs, increased water pricing and liberalisation of the automobile sector.

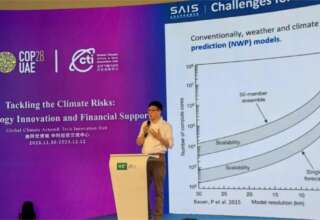

The staff-level agreement also entailed a new 28-month RSF arrangement, providing total access to around $1.3bn (1bn special drawing rights, or SDRs).

This takes the combined size of the IMF support to about $8.3bn. The additional RSF financing, unlike the bailout package’s biannual review and disbursement schedule, is subject to disbursement on completion of specific projects and policy actions to build climate resilience.

The board approval would be soon followed by another IMF mission visiting Pakistan to finalise the 2025-26 budget to be presented in the National Assembly in the first week of June.

The implementation of major reforms — including the carbon levy, water pricing and automobile protectionism — would begin gradually from July 1.

The overall ongoing fiscal consolidation will continue in the coming budget through a reduction in energy subsidies and tight development spending.