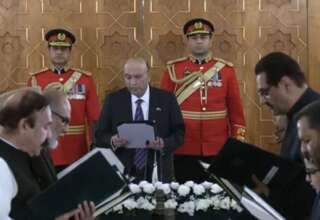

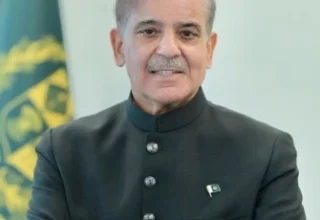

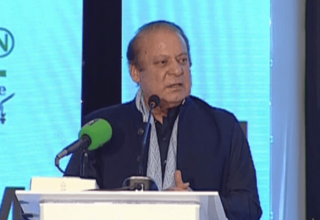

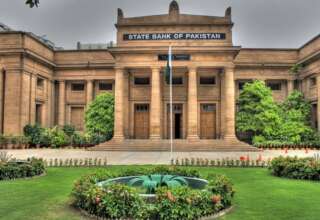

ISLAMABAD: The National Assembly on Thursday passed thefederal budgetfor the upcoming fiscal year, with an outlay of Rs17.57 trillion, despite opposition calls for the budgetary proposals to be made public and for the passage to be delayed until public input had been sought.

The House passed the Finance Bill for 2025 with certain amendments, incorporating around half of the suggestions put forward by the finance committees of both houses of parliament. All amendments proposed by the opposition were rejected.

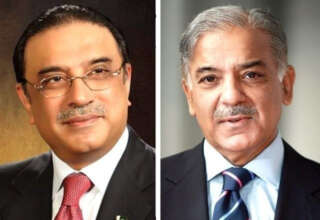

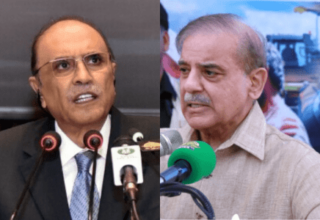

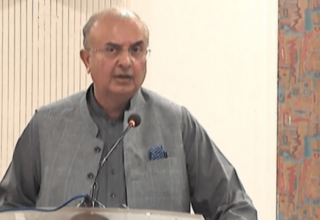

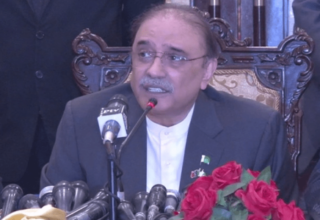

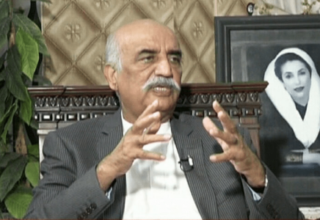

Speaking to lawmakers, PPP Chairman Bilawal Bhutto-Zardari explained why his party was supporting the federal budget. He highlighted an increase of 20 per cent in the allocation for the Benazir Income Support Programme (BISP), a flagship initiative originally envisioned by former prime minister Benazir Bhutto.

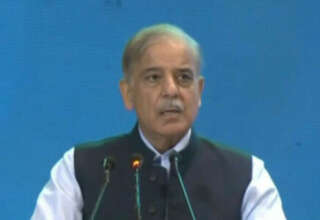

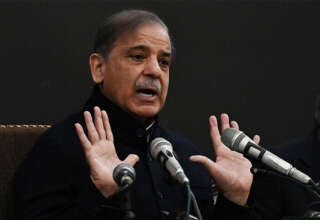

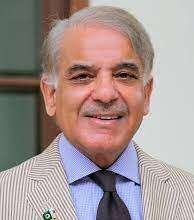

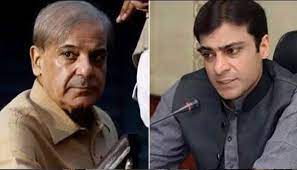

He criticised the previous PTI government for attempting to undermine BISP in every budget and praised Prime Minister Shehbaz Sharif for consistently increasing its funding since assuming office. Mr Bhutto-Zardari also noted that the government had raised the income threshold for tax exemption from Rs600,000 to Rs1.2 million annually.

The PPP chairman also pointed out that the tax on solar panels had been reduced from 18pc to 10pc following objections from PPP members.

He also welcomed the decision to curtail the arrest powers of the Federal Board of Revenue (FBR), noting that arrests in tax cases could now only be made in instances of proven fraud, not during the inquiry stage, and that such offences had been declared bailable. “These are the reasons why the PPP is supporting this budget,” he said.

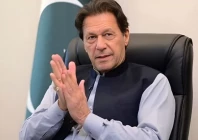

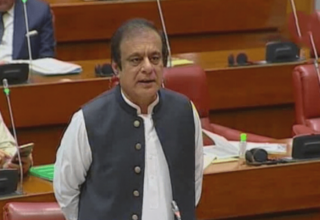

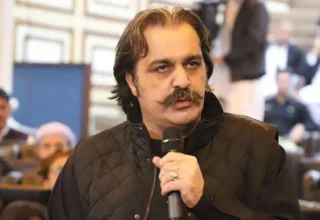

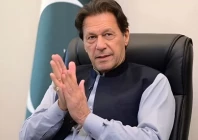

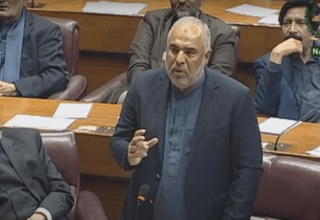

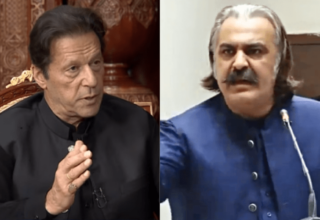

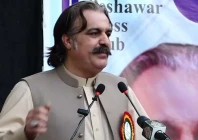

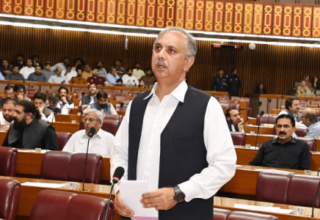

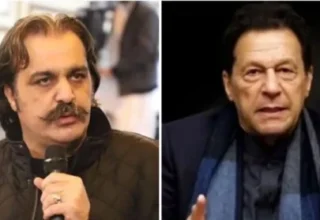

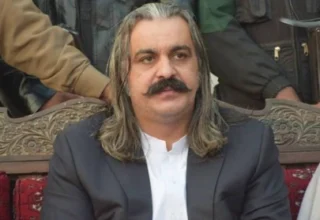

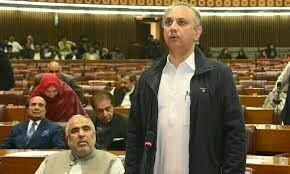

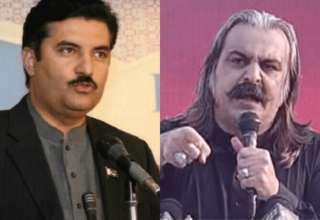

However, PTI Chairman Barrister Gohar Ali Khan criticised the federal budget as a “disastrous” 64pc deficit, which he argued would severely harm the country.

He expressed concerns that Pakistan’s economy could face a crisis similar to Sri Lanka’s, with the agricultural sector and large-scale industry failing, potentially leading the country to bankruptcy.

“Contrary to its claims, the government has failed to bring about economic reforms or complete the privatisation of any major entity,” he said. “That is why I will not say it is a visionary budget in the absence of any reforms”, he said.

Barrister Gohar also raised concerns about the allocation for BISP, which had been increased from Rs313 billion to over Rs700 billion, arguing that there had not been a fair distribution of funds across the country.

He criticised the new powers granted to the FBR to appoint auditors for evaluation and audit, calling it unconstitutional and in violation of Article 242 of the Constitution and relevant rules.

Malik Aamir Dogar of PTI argued that the government did not have a mandate from the public to present or approve the budget. He accused the government of consulting the IMF while preparing the federal budget but not consulting the public before its approval.

PTI’s Muhammad Atif Khan also questioned how a party that was not voted into power could impose new taxes on the people. He held the previous PML-N government (2013-18) responsible for causing a significant rise in capacity payments due to “dubious” power purchase agreements with independent power producers (IPPs).

Aliya Kamran of JUI-F moved a cut motion, criticising tax evasion and lack of transparency and accountability within the FBR system. Shandana Gulzar of PTI also criticised the government, accusing it of misleading the public about economic figures and implementing anti-people policies.

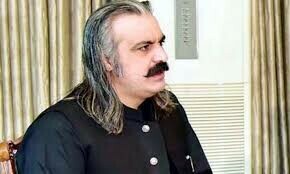

Ali Muhammad Khan, addressing Mr Bhutto-Zardari, asked him to become the voice of the poor masses and oppose measures like the imposition of new taxes on vehicles starting from 850cc.

Mobeen Arif of PTI proposed deferring the passage of the bill until the public had been consulted.

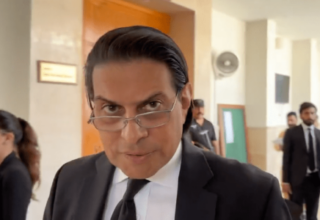

Latif Khosa, alluding to the country’s growing debt, questioned the government’s handling of loans, asking, “Haven’t you mortgaged three generations?” He added that nearly half of the population had fallen below the poverty line.

Opposition members strongly objected to granting arrest powers to FBR officials, arguing that the government had turned the “most corrupt” institution into a police force, potentially leading to harassment of citizens under the pretext of tax collection.

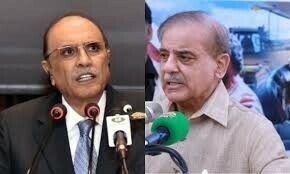

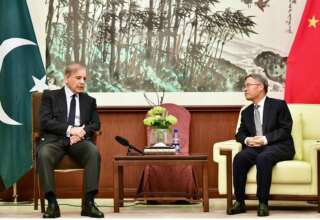

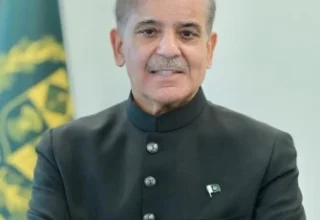

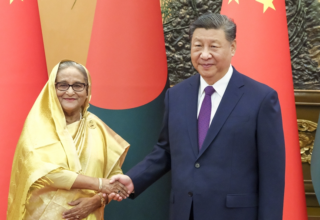

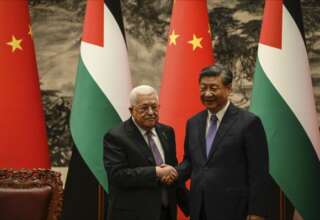

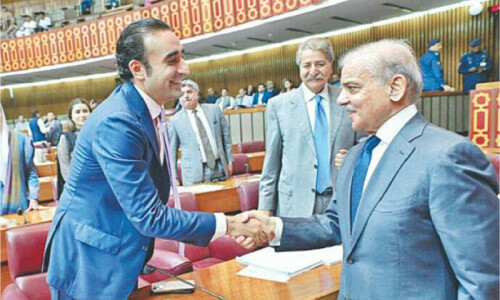

PM Shehbaz also attended the proceedings and met leaders from both sides of the aisle, including Mr Bhutto-Zardari.

Budget 2025-26

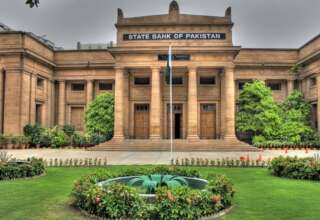

The federal budget for the next fiscal year projects an economic growth rate of 4.2pc and an inflation rate of 7.5pc. The net revenue receipts have been estimated at Rs11.07tr, with FBR collections projected to rise by 18.7pc to Rs14.13tr. Non-tax revenues are estimated at Rs5.15tr.

Key allocations include Rs2.55tr for defence, Rs1.06tr for pension expenditures, and Rs1.19tr for subsidies on electricity and other sectors. Relief measures in the budget include a 10pc increase in salaries, 7pc in pensions and tax relief for the salaried class across all income brackets.

The budget also includes Rs716bn for BISP and Rs1tr for the Public Sector Development Programme (PSDP), in which the largest allocation of Rs328bn is earmarked for transport infrastructure projects.

The PSDP for the next fiscal year has been aligned with the objectives of URAAN Pakistan, prioritising high-impact, near-completion foreign-funded projects and new initiatives of national importance.

Key infrastructure projects like Diamer Bhasha, Mohmand Dam and K-IV have been allocated Rs32.7bn, Rs35.7bn and Rs3.2bn, respectively. Besides, Rs10bn has been allocated for the lining of Kalri Baghar Feeder and Rs4.4bn for installing a telemetry system on the Indus Basin System.

The Higher Education Commission has been allocated Rs39.5bn for 170 projects. Additionally, Rs18.5bn has been earmarked in the PSDP for various education initiatives.

The agriculture sector will receive Rs4bn for 10 ongoing and five new schemes. The budget also includes incentives for the construction industry, such as a reduction in withholding tax on property purchases.